They arrive each month — those statements from your banks that detail everything your company is being charged for. Maybe they come in the mail, maybe electronically. They may be pages and pages long. The question is, how can you easily make sense of them? Here are some pointers for a good monthly account analysis review process.

What you should do each month with your bank fee analyses depends on

several factors:

- What does your boss say you should be doing with them?

- How much time do you have in a given month?

- What’s the likelihood someone will ask questions about balance levels or services spend?

- Are balances or service charges extremely important to your company at this time?

- Does managing balances or service fees factor into your performance review?

Let’s assume you have good motivation to dig into your account analyses, and enough time to do the job. Here’s a series of steps to help you sort through them.

- Has each bank sent a summary analysis for the month? If you don’t get summaries, that’s an issue — manually adding things across all your accounts takes time. For the moment, if you have to do a manual summary, maybe the 80-20 rule applies and you can time-box the work that way.

- Review each summary analysis quickly, and catalog four key indicators: average collected balance, ECR, balance assessment fee, and total service charges.

- Compare all these figures to the trend line that you’ve been keeping from previous months — or start the trend line now for future comparisons.

- Now, look into each of the four key indicators individually, as described below.

Average Collected Balance

Does your firm have targets for your average balances? Is being over-target more concerning than being under? How close were balances to the targets last month? If you’re off by a lot, say more than 20%, you may need to investigate. Things to check: how daily balance management is being done, whether there are frequent late-day transactions that are hard to predict, if there was an “event” (like a sale or purchase) that messed with your balances.

If you don’t have balance targets, then try to get the best return on your corporate cash, which normally isn’t ECR. Options have improved:

- Money fund spreads are running about 100 bp above ECR; banks are offering hybrid interest-bearing deposit accounts; maybe you can still find a sweep product.

- Do the breakeven on cost of moving funds vs additional income, and don’t run balances so low you risk an OD.

Targets or not — if you see a major balance spike, find out what caused it and be prepared for questions.

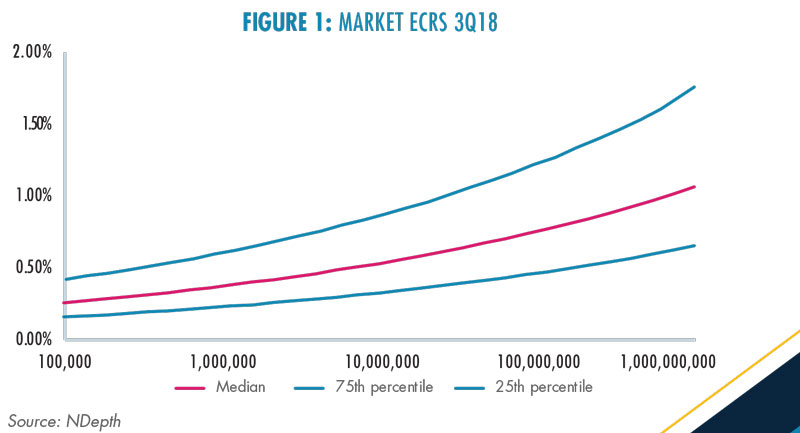

Earnings Credit Rate (ECR)

This should not be your default short term rate. If your first line of defense is keeping cash deployed at the best short term rate, then ECR is for balances you can’t reasonably invest. Still, nobody wants their ECR below the market median. Keep track of your ECRs; negotiate them up if you can, especially if you do generate lots of

operating balances.

Balance Assessment Fee (BAF)

This replaced the old FDIC charge. It’s charged on average ledger balances (while the ECR is against collected balances). Yes you can net the two for a “net effective rate”, which may be shockingly low.

Managing BAF can involve managing ledger balances. These typically arise in accounts where paper checks are deposited and funds are not immediately available. A big spike in ledger balances could indicate something out of kilter in your lockbox or over-the-counter deposit processes; check it out.

Total Service Charges

You do need to get into the nuts and bolts of your service charges, which takes time (see our article on doing this). But a cursory review each month should be your minimum requirement.

At each bank, look at total fees against your trend line. A deviation of more than 5% (increase) warrants scrutiny. If your company budgets for bank fees, you should know what kind of a monthly spike draws attention and questions.

You may want to keep a trend line of your largest line items, which will save time in that month when you spot a spike in total fees. Otherwise, lay this month’s analysis against last month’s and look for line items where charges are substantial. Depending on your business volume, this could mean a charge in the $100s or in the $1,000s.

Finding the big items that contributed to your spike gives you clues about what to do.

Here are some examples:

- “Bad behavior” fees like overdraft interest, phone call notification, and transaction repair. Solution — fix the underlying cause, teach people to use online services, put the kibosh on unnecessary manual services.

- Volume driven fees like high lockbox or wire volumes. This could be seasonal, cyclical or sporadic. Solution — find the explanation if you can’t make sense of it, knowing your company’s cash flows. You could learn something important.

- New services. Did you just start using data transmission of lockbox images? Besides new line items, this could generate substantial on-line inquiries out of the AR department. Major new service charges bear investigating, to be sure they’re what you ordered. Over time they become part of an expected trend line.

- One-time fees. These could be implementation fees, equipment charges, etc. There’s not really a solution here, but validate the items if you’re not aware of them ahead of time.

You can follow a similar, somewhat time-consuming process to confirm that your contract prices are being honored, if you have contracts with your banks.

These steps, as manual as they are, will help you be aware of and in control of your bank balances and fees every month.

Related Articles

Bank Fee Analysis, Ripe with Opportunity — New automated bank fee management solutions are providing state of the art tools and benchmarks. They even read PDF bank account analysis statements and avoid messy EDI 822 files. To save time and money, you can now just drag and drop.

Corporate Treasury Priorities — Each year, Treasury Strategies assesses the state of the treasury profession and key issues on the horizon. Top priority for this year is cash forecasting, treasury systems and optimizing treasury technology. Top benchmarking need is bank service fees.

Earnings Credit Rates Rise at Uneven Pace — Getting an allowance on your residual bank balances can be a nice source of income. Our NDepth earnings credit rate benchmarks show wide variances for the third quarter.

If you’d like to receive more information or a free custom report, please contact ndepth_info@treasurystrategies.com